Shireen Kapoor

January 14, 2025

The UAE continues to solidify its position as a global hub for business, innovation, and trade, with significant updates to its regulatory and financial frameworks set to take effect from January 2025. These changes are poised to enhance transparency, foster economic growth, and provide a stable environment for startups and businesses of all sizes. For entrepreneurs like yourself, the updates offer both challenges and opportunities. Here’s what you need to know

One of the major shifts in the UAE’s business environment is the continued rollout of the corporate tax framework, introduced in 2023. Starting in 2025:

Standardized Compliance Processes: Filing requirements have been simplified for small and medium-sized enterprises (SMEs), reducing administrative burdens.

Startup Exemptions: Qualifying startups with annual revenues below AED 1 million can continue to benefit from reduced or zero corporate tax rates, encouraging entrepreneurship and innovation.

These measures ensure that businesses like yours can thrive without being bogged down by complex tax regulations.

The UAE is committed to achieving net-zero emissions by 2050. In January 2025, new laws incentivizing green initiatives will come into force:

Tax Credits for Sustainable Practices: Businesses investing in renewable energy solutions or adopting eco-friendly practices can claim credits against their corporate tax liability.

Green Certification Subsidies: Startups that achieve certain sustainability benchmarks will be eligible for government grants, making it easier to adopt sustainable technologies.

This aligns perfectly with the UAE’s vision for a sustainable future while providing cost-saving opportunities for forward-thinking businesses.

The labor law amendments, effective January 2025, aim to create a fair and dynamic workplace environment:

Flexible Work Models: Businesses can now offer employees more adaptable working arrangements, including hybrid and remote setups.

Startup-Friendly Recruitment Policies: Employers in startup companies can benefit from subsidized hiring costs for UAE nationals, promoting Emiratization and workforce development.

These changes allow startups to attract and retain top talent while reducing operational costs.

To further bolster entrepreneurship, the UAE government has introduced a revised fee structure for obtaining and renewing trade licenses:

Discounted Licensing for Startups: Entrepreneurs will see reduced fees for business setup and license renewals.

Sector-Specific Incentives: Companies in priority sectors such as technology, renewable energy, and healthcare can avail themselves of additional fee waivers.

This step is aimed at making the UAE one of the most cost-effective places to establish and operate a business.

From January 2025, the UAE will enhance its e-government offerings to support businesses:

Streamlined Approvals: Faster online approvals for permits, licenses, and visas.

Enhanced Digital Portals: User-friendly systems to simplify interactions with government departments.

For startups, these upgrades mean less time spent on bureaucracy and more focus on growth.

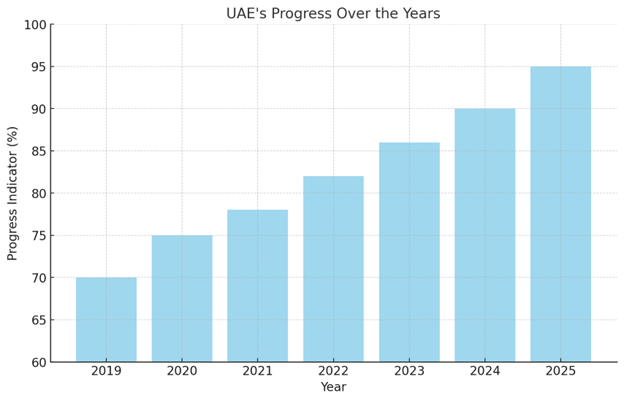

This chart shows the country’s steady improvement in key progress indicators, such as economic growth, innovation, and sustainability, from 2019 to 2025.

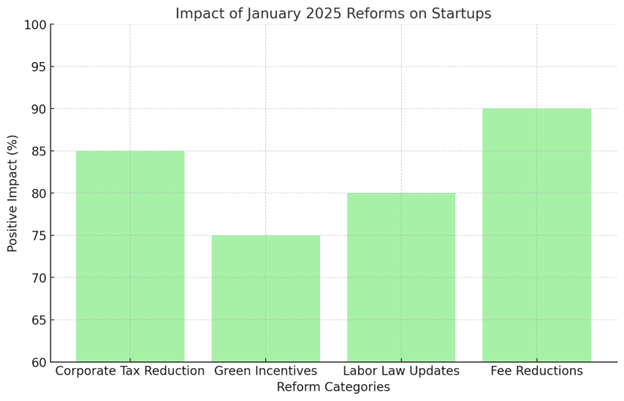

This chart highlights the positive impact of reforms, such as corporate tax reductions, green incentives, labor law updates, and fee reductions, on UAE startups.

The January 2025 reforms reflect the UAE’s unwavering commitment to fostering an entrepreneurial ecosystem that is globally competitive. As a startup owner, you are positioned to benefit from the enhanced ease of doing business, reduced costs, and abundant opportunities for innovation.

These forward-thinking initiatives make the UAE an ideal destination for launching and growing businesses in the region and beyond. By staying informed and proactive, your startup is set to thrive in this evolving business landscape.

The ASK Consultancy offers expert legal advice in the UAE, specializing in corporate law, residency, citizenship by investment, and real estate. We help clients navigate UAE laws with confidence and compliance. We are also officially registered with DIFC, ensuring adherence to the highest regulatory standards.

Copyright © 2024 ASK Consultancy